Contributed by: Eric M. Alderson, CRIS®, Risk Manager - Promark Agency

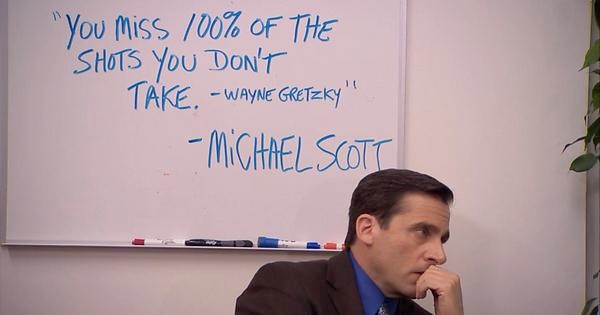

I’ll just say it -it isn't easy to get.

The more sophisticated your client, the less likely you are to get them to agree to this provision. But, 1) it’s always worth a shot, and 2) even if they don’t agree to the first attempt, they may agree to a broader variation, which is still a win. So, let’s back up and discuss what it means. A limitation of liability provision in a contract essentially caps your exposure to claims to a predetermined amount. Why is this important? Because most of your contracts are either silent about your maximum liability, or have provisions that sound something like this:

“…such indemnity obligations as outlined in this Agreement shall not be limited by reason of enumeration of any insurance coverage herein provided.”

Which basically means that regardless of whatever amounts or types of insurance your client required you to carry, if damages are in excess of those limits or beyond the scope of that coverage, you’re still liable. In other words, if you’re required by contract to carry $1 million of professional liability coverage, and damages are $2 million, you may potentially be liable out-of-pocket for that extra million. This is logical though, right? If you’re at fault, the total amount of the damages should be your responsibility. Well, courts are generally going to agree with that logic too and often award damages regardless of the insurance availability. I’m sure at least a handful of readers right now have been involved in claims where you ended up on the hook for something that you didn’t feel was completely your fault. It happens every day.

What can you do to protect yourself against this imbalance of fee and risk? Incorporate a limitation of liability provision into your agreements. Here are few examples:

EJCDC

“Engineer’s Liability Limited to Amount of Engineer’s Compensation. To the fullest extent permitted by law, and notwithstanding any other provision of this Agreement, the total liability, in the aggregate, of Engineer and Engineer’s officers, directors, members, partners, agents, employees, and Consultants, to Owner and anyone claiming by, though, or under Owner for any and all claims, losses, costs, or damages

whatsoever arising out of, resulting from, or in any way related to the Project or the Agreement from any cause or causes, including but not limited to the negligence, professional errors or omissions, strict liability, breach of contract, indemnity obligations, or warranty express or implied of Engineer or Engineer’s officers, directors, members, partners, agents, employees, or Consultants shall not exceed the total compensation received by Engineer under this Agreement.” - (EJCDC E-500-2008)

To include a variation for a specific dollar amount substitute with, “…Engineer’s officers, directors, members, partners, agents, employees, or Consultants shall not exceed the total compensation received by Consultant

or ($_________) whichever is greater.” - (EJCDC E-500-2008)

AIA

To a lump sum: “Except for acts amounting to willful or intentional wrongs, neither the Architect, Architect’s consultants, nor their agents or employees shall be jointly, severally or individually liable to the Owner in excess of the compensation to be paid pursuant to this Agreement (or (___________) Dollars ($___________), whichever is (greater/lesser)).” - (AIA B503-2017)

To the available insurance: “Except for acts amounting to willful or intentional wrongs, neither the Architect, Architect’s consultants, nor their agents or employees shall be jointly, severally or individually liable to the Owner in excess of the proceeds of the available professional liability insurance coverage required under this Agreement.” - (AIA B503-2017)

Note: the key in this one is AVAILABLE insurance coverage. If you limit your liability simply to the insurance limit, and that limit is eroded by other claims or if the claim itself is otherwise outside of the scope of your insurance coverage, you still have a gap and potential for out-of-pocket exposure. The term “available” reins it in just to those claim amounts your insurance program will actually respond.

ConsensusDocs

Understanding this is not the preferred standard form of agreement for use by design professionals, often designers end up being incorporated in this suite of forms in conjunction with contractor led design/build projects, who tend to gravitate toward this family of documents.

“Contractor’s entire liability for all claims or damages related to the Contract Agreement will not exceed the amount of any actual direct damages incurred by Owner up to the Contract Sum, regardless of the basis of the claim. This limit applies collectively to Contractor, its subsidiaries, subcontractors, and suppliers.” – (ConsensusDocs 200)

*the list of entities to whom this provision applies should be amended to include the design team for design/build contracts.

The takeaway is that you’re free to craft a limitation of your liability to an amount you deem appropriate, and is mutually agreed upon by your client, based on the project, your fee, scope of services, and associated risks. Keep in mind however that there is precedent in case law that says if the limit chosen is unreasonably low, in may not be upheld in court. With that in mind, sticking to the general guidelines offered by the standard forms of agreement is always a good idea. In fact, some jurisdictions even require the provision to be initialed by both parties to the contract for admissibility, so make sure any proposed additions or alterations to your contracts are reviewed by legal counsel.

Finally, as a negotiating tool, keep in mind that many of your clients are not averse to the existence of a limitation and in some cases will agree that you may be accepting an unreasonable amount of risk without one. But they may still resist because it isn’t presented in a way that they feel is negotiable. Instead, their risk manager simply strikes the provision in its entirety and tells you they can’t agree to the limitation. In those instances, don’t be afraid to use a step-scale approach to limit your liability in the same way you might negotiate the price of a new home. Start with the fee amount (or a base number if the fee is high) and work your way up to the available insurance limit. Common stops along the way are $10k, $25k, $250k and up. For larger projects, it is common for a combination to be offered at the amount of the fee or a specified amount, whichever is greater. Remember, it’s in your insurance carrier’s interest for you to incorporate these provisions (at amounts less than your insurance limit) and if you do, they offer significant premium discounts of as much as 25% credit on your policy premium. So again, it may not be likely, and you may not get it every time, but you never will if you never ask.

For more information, sample provisions or questions, please don’t hesitate to contact me anytime. I’m happy to help.